Income Tax Form Malaysia

Choose the right income tax form.

Income tax form malaysia. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Once you ve logged in you will be shown a list of features available on e filing.

If malaysian income tax office found the difference between an actual and estimated tax you will be charged with 30 fine instead 10. This is because the malaysian irb inland revenue board has provided an online system which automates the entire process making it so much easier for individuals and businesses to carry out their annual tax assessment and clearing whatever is pending between the income earner and the board. Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn.

Isnin hingga jumaat 9 00 am hingga 5 00 pm. As an employer are you aware of the reporting obligations under the malaysian income tax act 1967. Tax administration diagnostic assessment tool tadat association of tax authorities in islamic countries ataic perundangan.

Hasil care line 03 8911 1000 603 8911 1100 luar negara waktu operasi. Penalty of late income tax payment. You will be charged with 10 additional cost if you fail to pay monthly instalment tax.

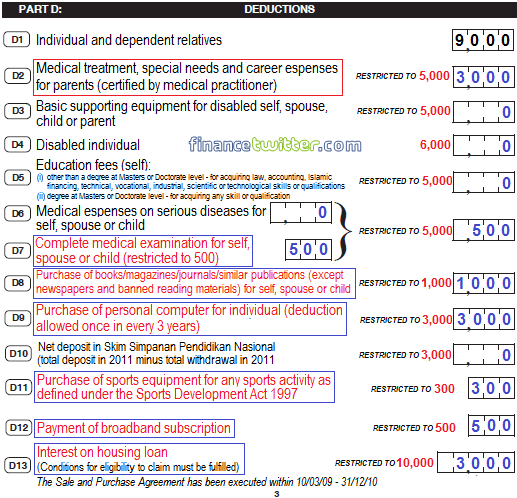

Here is a list of income tax forms and the income tax deadline 2019. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.

Submitting your income tax forms in malaysia is very easy.