Islamic Financial Services Act 2013 Penalty

Persons approved under financial services act 2013 to carry on islamic financial business division 2 restriction on dealings of authorized persons 15.

Islamic financial services act 2013 penalty. Types of islamic deposit products. This chapter aims to highlight the background of islamic financial services act 2013 ifsa. On 30 june 2013 the financial services act 2013 and the islamic financial services act 2013 collectively referred to as acts have come into effect by substituting and repealing the banking and financial institutions act 1989 the insurance act 1996 the payment systems act 2003 the exchange control act 1953 the islamic banking act 1983 and the takaful act 1984.

Ifsa 2013 and deposit products. Authorized person to carry on authorized business only 16. The islamic financial services act 2013.

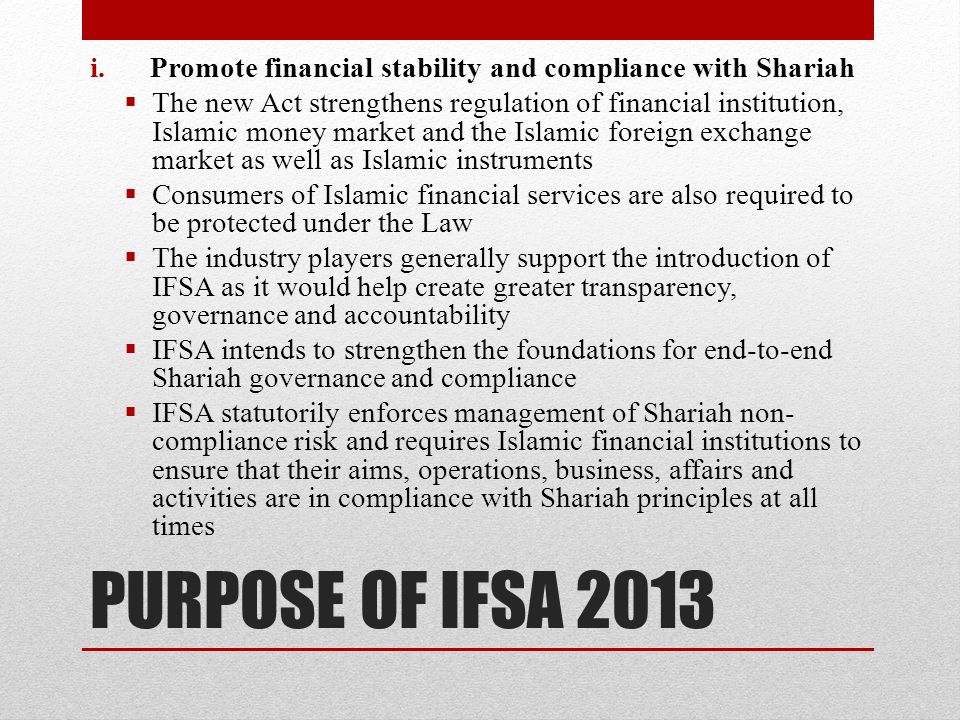

The next level of sharīʿah compliance commitment after three decades of islamic finance development malaysia attempted to further strengthen the sharīʿah governance and sharīʿah compliance commitment of the islamic financial services industry by legislating the islamic financial services act ifsa 2013. It replaced the banking and financial services act 1989 the insurance act 1996 the payment systems act 2003 and the exchange control act 1953. The islamic financial services act 2013 malay.

Shariah compliant requirements of ifsa 2013. Akta perkhidmatan kewangan islam 2013 is a malaysian laws which enacted to provide for the regulation and supervision of islamic financial institutions payment systems and other relevant entities and the oversight of the islamic money market and islamic foreign exchange market to promote financial stability and compliance with shariah and for. The imposition of an administrative penalty is provided for under section 7 1 c v of the financial services act fsa and section 93 2 aa of the fsa further provides that notwithstanding section 53 fsc rules may provide for the imposition of an administrative penalty in relation to such matters as may be prescribed.

Significant features of ifsa 2013. Licensed takaful operator to carry on family takaful or general takaful business division 3 representative office 17. 6 any reference in this act to this act the islamic financial services act 2013 or the central bank of malaysia act 2009 shall unless otherwise expressly stated be deemed to include a reference to any rule regulation order notification or other subsidiary legislation made under this act the islamic financial services act 2013 or the central bank of malaysia act 2009.

Islamic financial services act ifsa 2013 and the sharīʿah compliance requirement of the islamic finance industry in malaysia june 2018 isra international journal of islamic finance 10 1 94 101. Enforcement of penalties. Introduction to the islamic financial services act 2013 ifsa objectives of ifsa 2013 in malaysia.

The analysis is tackled along the lines of the background and the constitutional frameworks of the country the initiatives introduced by the government for the development of shari ah compliance within the islamic banking and finance.